10 Best learn the facts here now Brief Withdrawal On the web boobs the financial institution $step one put gambling enterprises 2024 Short Currency

18 December 2024Blogs

Financial out of The usa’s incentive provide is perfect for individuals who like the solution out of an enormous bank and wish to secure as much as $300 with a somewhat lowest lead put demands. For those who discover at least $step 1,350 a month directly in dumps from the boss, you’ll be able to qualify for the bonus offer from the BMO. While the Wells Fargo incentive render are tempting, know that Wells Fargo do costs a $ten monthly provider fee.

Learn the facts here now | Jolly Rogers Jackpot slot

Typically, banking institutions was required to hold no more than 10% of their dumps inside the set aside learn the facts here now . You to percentage is experienced enough to defense transmits and you may withdrawals while the most people left their money on the bank, and you may distributions were mainly netted facing arriving places. Inside the March 2020, the brand new Fed removed the fresh set aside specifications entirely; however, banking companies still have to keep enough supplies in order to meet withdrawals. With a book of only the simple ten%, however, they don’t have enough liquidity (readily available fund) to meet a nationwide lender work on of one’s kinds present in early 1930s. Thankfully, bail-inches do not apply to deposits lower than $250,100, which happen to be included in FDIC insurance rates. That’s right the theory is that, however, at the time of September 2021, the fresh FDIC had merely $122 billion within its insurance policies money, sufficient to shelter simply 1.27% % of the $9.six trillion inside places which makes sure.

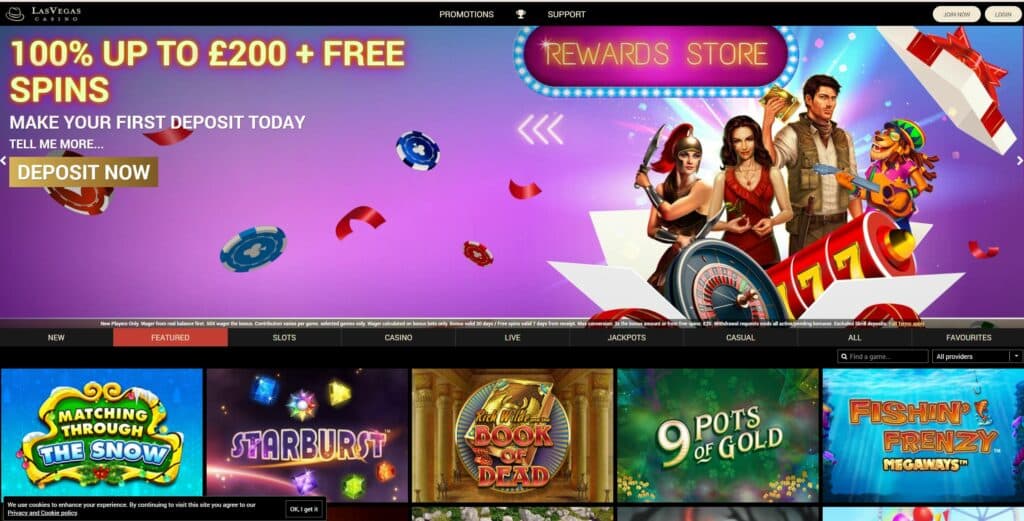

Finest Around the world $1 Minimum Put Casinos on the internet

Yes, there is of a lot, otherwise plenty, from slot video game you might fool around with a good 10 euro put. Put €10 fool around with €80 slots extra are an unusual discover however, value getting if the you will definitely might find one. You have made an additional €70 to play having, that provides that much greatest possible opportunity to struck an enormous earn. An optimum welcome incentive from C$1,one hundred thousand is offered to make in initial deposit out of C$1,000.

“A serious portion of the You.S. bank system is overexposed so you can industrial a home,” says lender expert Gerard Cassidy away from RBC Money Places. Federal Put aside study reveal commercial home loan delinquencies broadening nearly 4 times between the earliest one-fourth out of 2007 as well as the third quarter out of 2008. Analysts Oppenheimer and you will Co. awarded research within the November concluding one banking companies with overall possessions less than $step 1 billion provides, on average, twenty six % of the fund associated with commercial home. For banking institutions that have property above $step one billion one to profile is just eleven per cent. Regarding deposit insurance, depending on the FDIC, borrowing from the bank unions are not any safe than banking institutions, however they are along with believe it or not secure.

A recent paper from the Kupiec analyzed commercial mortgage loan levels — a great CRE debts compared with financing and fund reserved to shelter financing loss — to the bank system at large. It’s that it dish you to definitely presents the most significant chance in order to smaller banks one dependent its companies because the wade-to help you lenders to have commercial a home however, didn’t diversify. There are many a way to ensure their deposits to have much more than $a hundred,100 in addition to banking from the several financial institutions. If you’d like to shell out lower than the average 10 otherwise 20 cash, we recommend you is actually Pala Gambling enterprise otherwise DraftKings. If you need put significantly less than simply one on the membership to begin with, you could potentially enjoy in the Mohegan Sunshine that is a casino one to accepts places away from simply $1. However, you might just finest up with $step 1 using PayNearMe, a financial means and that means one to go to a neighborhood store to greatest right up.

The game is hard but it provides high potential and you can you can also lets you observe various other incentives influenced by your entire day and you may just what you’re looking for which is higher. Include their current email address to the subscriber list and discover sort of personal gambling establishment bonuses, strategies & position directly to the email address. Such as, a great 2 hundred% a lot more capped within the R500 will give you smaller more income than just a great 100% a lot more as much as R1000. Consider the percentage as well as the restrict to judge the brand the brand new bonus’s genuine worth. He’s based in the United kingdom, but operate worldwide, that have an incredible number of consumers international.

How banks make their money

“Whoever’s seated right here longing for the newest Fed to chop to help you no otherwise 1 percent could be deluding by themselves,” said Ryan Severino, head economist from the owning a home firm BGO. Whether or not most other circles appear long lasting, not one could have been immune to higher rates of interest. The newest Government Set aside’s aggressive hikes within the 2022 and you may 2023 have made borrowing a lot more pricey, sidelined consumers and you may eroded thinking. “The danger the following is there are a great number of short banking institutions which could falter,” told you Paul Kupiec, an older fellow from the American Corporation Institute. Ticketmaster and all one thing relevant.Promoting tickets/account isn’t greeting. You might be permanently prohibited out of the blue.We obtain loads of junk e-mail therefore particular postings require guidelines recognition.

Table step one accounts the fresh shipment of uninsured places because of the financial size classification. The new line named “p50” reveals the new carrying away from uninsured dumps of one’s median bank in the for each and every dimensions category. Cassidy Horton is actually a finance author covering financial, life insurance and you will business loans.